Bill comes due for money-losing tech companies that borrowed billions

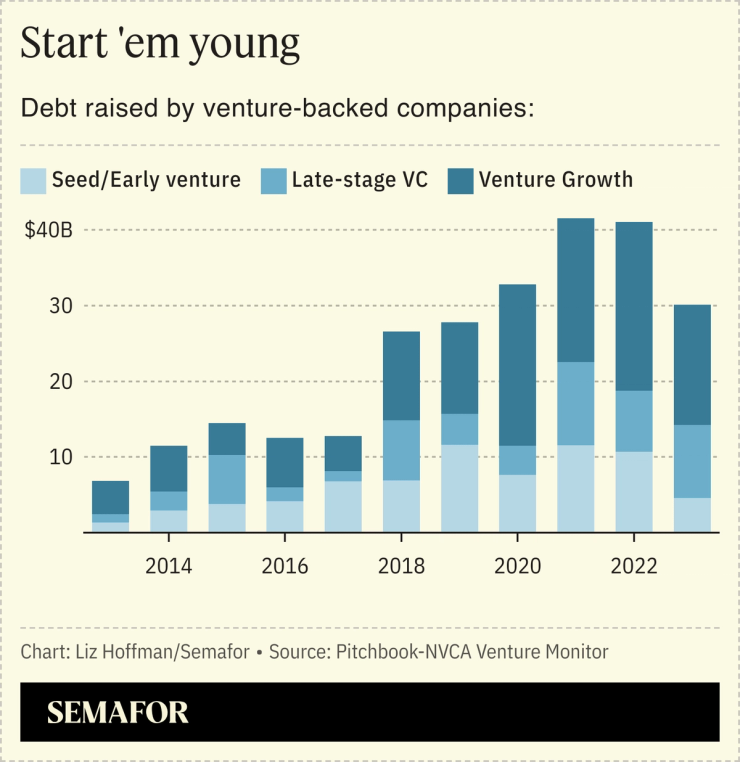

Like many standards of financial prudence, the idea that only mature and profitable companies could handle debt started to go out of fashion in the 2010s. Startups like Uber, which were operating at a loss, needed more cash to push into new markets. And because they had been private for so long, they had largely exhausted equity investors in Silicon Valley, who didn’t want their stakes to be diluted even further.

Borrowing solved both problems. Uber and Airbnb each borrowed more than $1 billion from investors in 2016, before private credit was a household term.

It was a profitable strategy for lenders too: A 2018 study found the 10-year returns for venture debt were slightly better than those of venture equity, turning the risk vs. reward calculus in Silicon Valley on its head.

Traditional underwriting standards held on as long as they could, and as recently as 2021, a credit analyst at S&P could call ARR lending a “platypus… so rarely seen that most people know little about it.” At the end of 2019, Thoma Bravo turned heads with the largest ever such loan, $825 million to finance the buyout of an online learning-software company.

Two years later, Thoma Bravo took out a $2.9 billion ARR loan provided by Blackstone, Ares, and Blue Owl, among others, to finance its takeover of Anaplan. Later that year, its chief rival for tech buyouts, Vista, used a $2.5 billion ARR loan to buy Avalara. Neither company had ever turned an annual profit.

What started as a small club of lenders willing to lend to unprofitable companies grew quickly, and by the early 2020s, two dozen firms were in the business. Rubin estimates ARR loans are about 5% of private-credit financing deals Proskauer does.

“It used to be if the five players said no, that deal didn’t happen,” he said. “But if the next five say yes, suddenly it does. That’s not to say it’s a bad asset, but there’s probably more risk in the system.”